The invisible credit card of the future

Janet

Janet

2020/01/09

2020/01/09 12896

12896 0挑错量:0

0挑错量:0

Imagine strolling into your local supermarket, popping your essentials into a basket, heading to the bagging area - where no items are unexpected - and walking out with your weekly shop.

There is no need to make a payment, no fiddling with coins, and no placement of a debit or credit card in a terminal. In fact, there is no till at all.

This is not casual shoplifting but a realistic prospect of the future way to pay - when technology recognises your presence, scans your shopping, and invisibly takes payment from your account.

Amer Sajed, the chief executive of Barclaycard, says it will spell the steady demise of the physical plastic credit card, which his company introduced to the UK 50 years ago.

"People will be able to seamlessly shop going between the web, an app or in store," he says

It will also create a battle for control of your digital wallet between banks and technology companies, as well as prompt debate over our privacy and security.

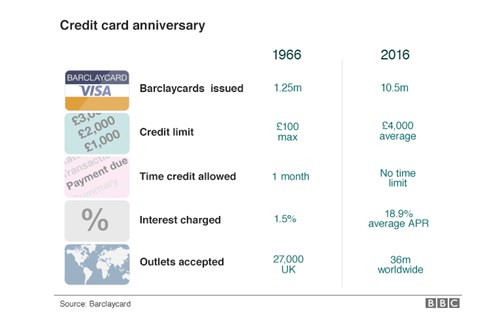

Credit cards have evolved since 1966, but the basic procedure of payment has remained the same. A card is either handed over, or the number on it is read out or entered into a machine.

All that requires the existence of a plastic card, but Mr Sajed says this is being replaced by wearable items.

At a display for Barclaycard staff, he shows off a plastic ring, a bracelet and a keychain which all contain a chip allowing the shopper to make payments on credit.

This, he says, is just a bridge to technology that will see customers identified by their eye or fingerprint, located via their smartphone, and able to shop without queuing up at a checkout.

Although cash, cheques and indeed cards will remain an option for shoppers, he says, these new ways of paying will take a growing share of the payments market in 10 years’ time.

Such a prospect sounds frightening for anyone who already has concerns about corporations, and potentially hackers, tracking our whereabouts or spending habits.

Mr Sajed argues that nothing will be done without permission.

"We would never track anyone’s location or data without their express knowledge. and it would only be for things that the customer has allowed us to do."

There is an extra benefit, he says, as it is much easier to authorise a transaction when a card company knows a customer’s location. It is easier to stop fraud for the same reason.

A link in the background between the individual and the payment system is required for any of this to work. This already happens with shopping portals like Amazon and services such as Uber allowing a single-click transaction because bank or credit card details are loaded when the customer first signs up.

"These emerging technologies still use the existing, underlying rails of the card payments system," says Richard Koch, head of policy at the UK Cards Association

As this digital market becomes more prevalent, and the technology advances, there will be a battle among banks, payment providers and others for their product to be used.

The UK Cards Association predicts there will be almost 21 billion "card" transactions in the UK in 2025, up from 12.6 billion last year. Of these, 3.6 billion will be credit card purchases compared with 2.5 billion last year.

评论:

- 信息过量取决于怎么读,而不是读什么2020/01/09

- 研究:女性每天至少“嫌弃”自己8次2020/01/09

- 18至30岁是人生最艰难的时期2020/01/09

- 实用技能get:面试时如何有效介绍自己2020/01/09

- 同一款洗发水用久了真的会失效吗?2020/01/09

- The invisible credit card of the future2020/01/09